ING Broker experiences and test 2023

The ING online broker focus is on simple securities trading

The ING review has it all, because the broker offers a lot. Traders can look forward to diversity in their investment decisions: stocks, ETFs, certificates, bonds, funds, leveraged products, etc. More variety is hardly possible, especially when it comes to savings plans. If you want, you can start with little equity and work continuously on asset accumulation through the lucrative savings plans. If you have more budget at your disposal, you can invest in more than 18,000 securities on the world’s stock exchanges. Access is convenient with the app or the user-friendly web application. The ING test brings even more highlights to light. What are they? Just follow the review.

New customer offers & account switching: Registration on recommendation brings credit

If you register as a new customer and come on recommendation, you can look forward to it. The broker donates 20 euros and 10 free trades for all newly registered users. The free trades are available for the first six months. Only the third-party costs have to be borne by the customer.

In order to collect the bonus, recruited new customers must act within six weeks: either a securities savings plan or a securities transfer with a volume of €1,000.

ING experience with usability of the website: max. clarity

The fact that ING appears reputable is noticeable in the website design. The broker relies on clear colors and skilful menu navigation. A white background really brings out the grey-black font with highlights of dark blue and orange design elements.

When it comes to the menu overview, traders can expect maximum user-friendliness. A bit confusing at first, as all services are available on the website:

- Current account

- Save

- Invest

- Construction Financing

- Credits

- Insurances

If you navigate unerringly to the “investing” section, you will immediately find everything at a glance. Here you can select stock exchanges and more, promotions, savings plans, securities searches, and watchlists. Nicely arranged, as hardly expected otherwise in the ING serious.

If you want, you can also download the ING DiBa mobile app. It is available free of charge for Apple and Google devices. This allows not only the account but also the custody account to be optimally managed. Buying securities, creating savings plans and the like – is easily possible with a smartphone or tablet without any charging delay.

ING Accounts Rating: 1 Account and All Possibilities

ING’s experience with account solutions has been positive. The broker relies on a simple structure: one account and everything in view, including the ING DiBa fees. With the opening of the trading account, traders now have the opportunity to use securities and the like to build up assets.

There are a few steps involved in registering, as with other brokers. In addition to personal data, further information is also included:

By getting to know its traders, ING protects them, because overly risky financial instruments can be kept away by inexperienced traders. However, there is no ING demo account for practice.

However, traders can use the watchlist to simulate a security purchase. Of course, this feature does not replace an ING demo account with virtual credit. Nevertheless, traders can see through the simulation that securities trading is handled at ING.

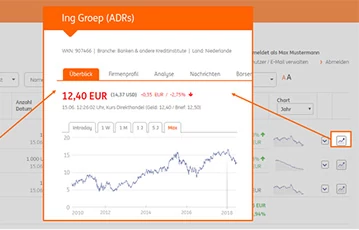

ING test of trading platforms: market overview and analysis tools available

Part of the ING experience report is also the impression of the trading platform. It differs significantly from the well-known MT4 in terms of features. The broker relies on an individual solution that is also suitable for beginners. Nevertheless, there is a lack of clarity and functionality in some places.

The number of technical indicators for price analysis as in MT4 is not available here. Nevertheless, markets and price movements can be analyzed with various free tools. Since there is a lack of explanations and training opportunities, trading beginners have a somewhat harder time.

With the help of the watchlist, the selection of securities in particular is much easier. Investors can analyze and sort by:

- Security name

- Number of shares

- Pars

- Changes in prices compared to the previous day

- Performance compared to another price, etc.

The watchlist is also available on the app, which makes location-independent market observation even easier.

ING experiences with payments very monotonous

In the broker comparison, there are providers who offer more than five payment options. What are the ING experiences in this category? Traders don’t have to worry about dubious payment service providers. If you open your custody account with ING DiBa, you link it to a reference account. All payments are transferred via this.

There are no hidden ING costs for the settlements. Deposits are realized free of charge, as is the payment of winnings. When it comes to the minimum amounts, traders do not have to limit themselves at all. The broker dispenses with this and offers maximum flexibility in transactions.

Customer service in the ING test: even 24/7 support in Germany

Fortunately, the experience in the ING test with the support is positive. Traders can even look forward to 24/7 support. Even better, there is even German-speaking support based in Frankfurt.

The ING rating is particularly positive because of the different communication channels:

- Live chat (initially with a robot)

- Telephone

- Online

Inquiries can be directed to support 24/7. The answer is given, especially online, within a very short time. If you want to contact support by phone, you can contact the staff at certain times. If you have any questions about securities, numerous contact persons are available by telephone between 37:22 and 00:<> Monday to Friday and on public holidays with stock exchange trading. The phone number for this is even in Germany.

ING Review on Regulation & Deposit Insurance: Increased Deposit Protection for Traders

The fact that ING works seriously is already evident from the broker’s location in Germany. This means that ING is subject to the German Federal Financial Supervisory Authority and must comply with German regulations.

Ideal for all traders who have risk concerns about broker selection. ING will dispel them, also through increased deposit insurance. The ING experience shows that the broker has set itself the task of protecting customer funds as high as possible. Customer deposits are generally covered up to €1.37 billion. In addition, the liquid funds are kept separately from the broker’s own funds. In comparison, even more protection is hardly possible.

Contact online via chat is also possible. In order to bring about faster help, a robot first takes over. He asks for the help topic and, if desired, refers to a real support employee.

ING Evaluation of the additional offers: Banking solutions for everyone

In the ING test, it is noticeable that ING provides much more than just brokerage services. The company’s focus is primarily on banking. If you want, you can open an ING Diba current account and secure various savings opportunities. Other offers include:

- Mortgage lending

- Credits

- Insurances

With this extensive offer, ING is a true all-rounder among brokers. The highlight: All offers can be conveniently managed via an account and even via the app. In this respect, ING DiBa Banking also offers many other services.

Stock Trading Offer

If you have always wanted to trade securities, you should gain experience with the purchase of shares at ING-DiBa and register free of charge. There are more than 18,000 securities to choose from, with more than 540 also being covered in savings plans. The total security selection is perhaps a little smaller compared to other brokers, but ING focuses on the most important companies and trading venues.

To make the search easier, a separate function is available. Traders can choose whether the securities should come from a specific industry sector, for example. It is also possible to choose from:

- Country-Region

- Analyst consensus

- Dividend

- Market capitalization

For those who want to first observe how the price value develops, the watchlist is suitable. It helps to compile interesting securities and observe them at a glance. In addition, it can be used in a similar way to an ING demo account: without virtual credit but with a trading simulation for securities.

Stocks Trading Costs

The ING costs of trading securities can be summarized transparently:

- €4.90 basic fee plus 0.25% of the market value

- Maximum € 69.90 (including basic fee)

In addition, ING fees are added for a trading venue. For example, if traders buy securities in direct trading, these costs are eliminated. However, if you trade on other stock exchanges, you have to expect additional fees:

- €1.90: Xetra, Stuttgart, Euwax, Frankfurt Certificates

- 2,90 €: Frankfurt, Munich, Berlin, Dusseldorf, Hamburg, Hanover

- €14.90: foreign trading venues

Compared to other brokers, the costs are transparent, but do not belong to the cheapest offers.

Stock exchanges and trading venues

At ING, securities trading is possible on the most important stock exchanges worldwide: all stock exchanges in Germany (Frankfurt, Munich, Berlin, Düsseldorf, Hamburg, Hanover, Stuttgart), the USA and Canada. Access to direct trade is also provided.

Product Summary & Conclusion on ING Shares

ING’s experience with the securities offering has been positive. With more than 18,000 shares, the broker is not one of the best providers, but it is still suitable for getting started. Traders can trade securities on all German as well as selected American and Canadian stock exchanges. Direct trading is also possible and even without additional ING costs. In general, the fees are transparent, but from € 4.90 they are not among the cheapest.

ETF Trading Offer

ING’s experience with ETFs is better than with the certificates. Traders can look forward to more than 1,900 offers. Here, too, there are more than 150, which are even available free of charge. The ETFs at ING DiBa are also available as savings plans.

ETF Trading Costs

The ING costs for trading the ETFs are variable. There are always promotions where traders do not have to pay any fees for the purchase. Prerequisite: €1,000 order volume.

Otherwise, the costs are € 4.90 plus 0.25% of the market value. A maximum of €69.90 will be charged.

ETFs are offered by Amundi, BNP Paribas Easy, Fidelity, Franklin LibertyShares or iShares, among others – even without fees. The transactions in direct trading are processed via Tradegate.

Product Summary & Conclusion on ING ETF

The ING rating on the ETFs is positive in terms of offers. There are more than 1,900 ETFs to choose from, many of which are even free of charge. The conditions are not favorable from € 4.90 in terms of commission, but traders can choose the free promotions. If you don’t want to invest directly, take advantage of ETF savings plans, which are also available from ING.

Certificates Trading Offer

In the ING test, the selection of certificates performs less well compared to other brokers. Only gold and silver certificates are offered, in a savings plan. For traders who want to work on wealth accumulation with regular investments, this is a good thing. If you want real certificate trading, you won’t get your money’s worth here.

Certificates Trading Costs

The ING costs for trading the certificates are surprisingly low. There are even some promotional certificates that can be traded from €0. Traders have the opportunity to use the certificate search to select exactly these cost-effective offers.

Stock exchanges and trading venues

Certificates are offered by the best-known issuers. In total, more than 15 are available. These include DZ Bank AG, BNP Paribas, iShares.

Product Summary & Conclusion on ING Certificates

The ING assessment of the certificate offer is only partially positive. Traders need to know that certificates are offered here exclusively as savings plans. In terms of costs, however, the result is more positive, as the certificates are available from as little as €0.

Result

The overall ING rating is positive due to the various financial products. Traders can find selected securities, ETFs or certificates for the portfolio. With more than 18,000 certificates and over 1,900 ETFs, ING is not one of the top providers. Nevertheless, the well-chosen selection is optimal for getting started. If you want, you can first concentrate on the savings plans and work on asset accumulation through individual installments. However, there is no ING demo account available for testing. On the other hand, ING makes it easy to get active with the free account. Once registered, traders can monitor all markets with an account and even via the ING app and make trading decisions comfortably.

The Review

ING Broker

The ING Direct broker is a large international financial corporation headquartered in Amsterdam. It provides services in the banking sector, as well as to legal entities and corporate clients throughout Europe. America’s Fortune magazine ranked ING among the Top 20 largest global brokers. The main aspect of ING Direct's brokerage activity is trading in stock markets where clients can work independently or through investment funds.

PROS

- Highly regulated

- High reputation

- large trainingsection

- No commission

CONS

- Limited range of trading instruments.

- Complex procedure for opening an account

- lack of languages

Review Breakdown

-

Trading experience

-

Trading conditions

-

Platforms and tools

-

Range of market

-

Commissions and fees

-

Safety and security

-

Customer support